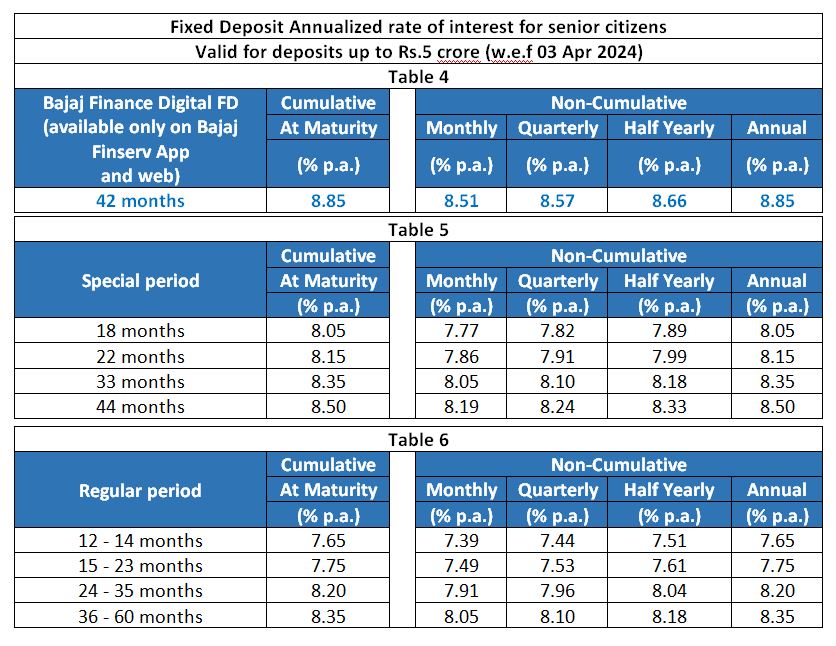

Bajaj Finance NBFC : Bajaj Finance Ltd, part of financial services major Bajaj Finserv Ltd, on Monday announced hikes in fixed deposit (FDs) rates across most tenures. Effective April 3, 2024, the company has increased FD rates for senior citizens by up to 60 basis points (Bajaj Finance NBFC) in the 25-to-35-month tenure and 40 basis points in the 18-to-24-month tenure.

Bajaj Finance NBFC hiked FD interest rates up to 60 bps

“For non-senior citizens, rates have been hiked by up to 45 basis points in the 25-to-35-month tenure, 40 basis points in the 18 and 22 month tenures, and 35 basis points in the 30 and 33-month tenures,” it said in a statement.

Senior citizens can continue to avail FD rates of up to 8.85% and non-senior citizens can take benefit of rates of up to 8.60%, by booking digitally in the 42 months tenure.

Sachin Sikka, Head – Fixed Deposits & Investments at Bajaj Finance, said, Our enhanced rates across several investment buckets presentan attractive proposition for investors seeking stability. Over the years, millions of depositors have placed their trust in the Bajaj brand. We continue to stay focused on offeringthem a better experience, more value and a safe option for their savings.

Bajaj Finance’s customer franchise stood at approximately 83.64 MM as of March 31, 2024. The company has emerged as the country’s largest deposit-taking NBFC with a Deposits book of over Rs. 60,000 crore as of March 31, 2024.

The Bajaj Finance Fixed Deposit program has the highest stability ratings with CRISIL’s AAA/Stable and ICRA’s AAA(Stable), offering one of the safest investment options for investors.The company’s App also offers an Investment Marketplace where customers can access a wide array of mutual funds.

ALSO READ – Bajaj Group Unveils ‘Bajaj Beyond’ : commits Rs 5,000 crore over next five years